Donating to a Non-Governmental Organization (NGO) is not only a noble way to contribute to society but also offers concrete financial advantages, primarily in the form of tax savings. For those who wish to support a meaningful cause while maximizing their financial efficiency, making tax-deductible donations to registered NGOs can be an ideal approach. Let’s explore how this works:

Tax Deductions and Exemptions

In many countries, contributions to specific NGOs are eligible for tax deductions, which effectively lower the donor’s taxable income. For instance, in India, donations made to registered NGOs that qualify under Section 80G of the Income Tax Act are eligible for tax exemptions. Here’s how this benefits donors:

Reduced Taxable Income: By deducting the donation amount from your income, you can significantly reduce the portion of your income that’s subject to taxes. This is a straightforward way to lower your tax liability.

Percentage-Based Deductions: The deduction percentage varies depending on the NGO’s classification, with some donations qualifying for a 50% exemption, while others may be eligible for a full (100%) deduction. High-impact NGOs working on priority issues like disaster relief or child and women empowerment often fall into the latter category, providing more substantial financial relief to donors.

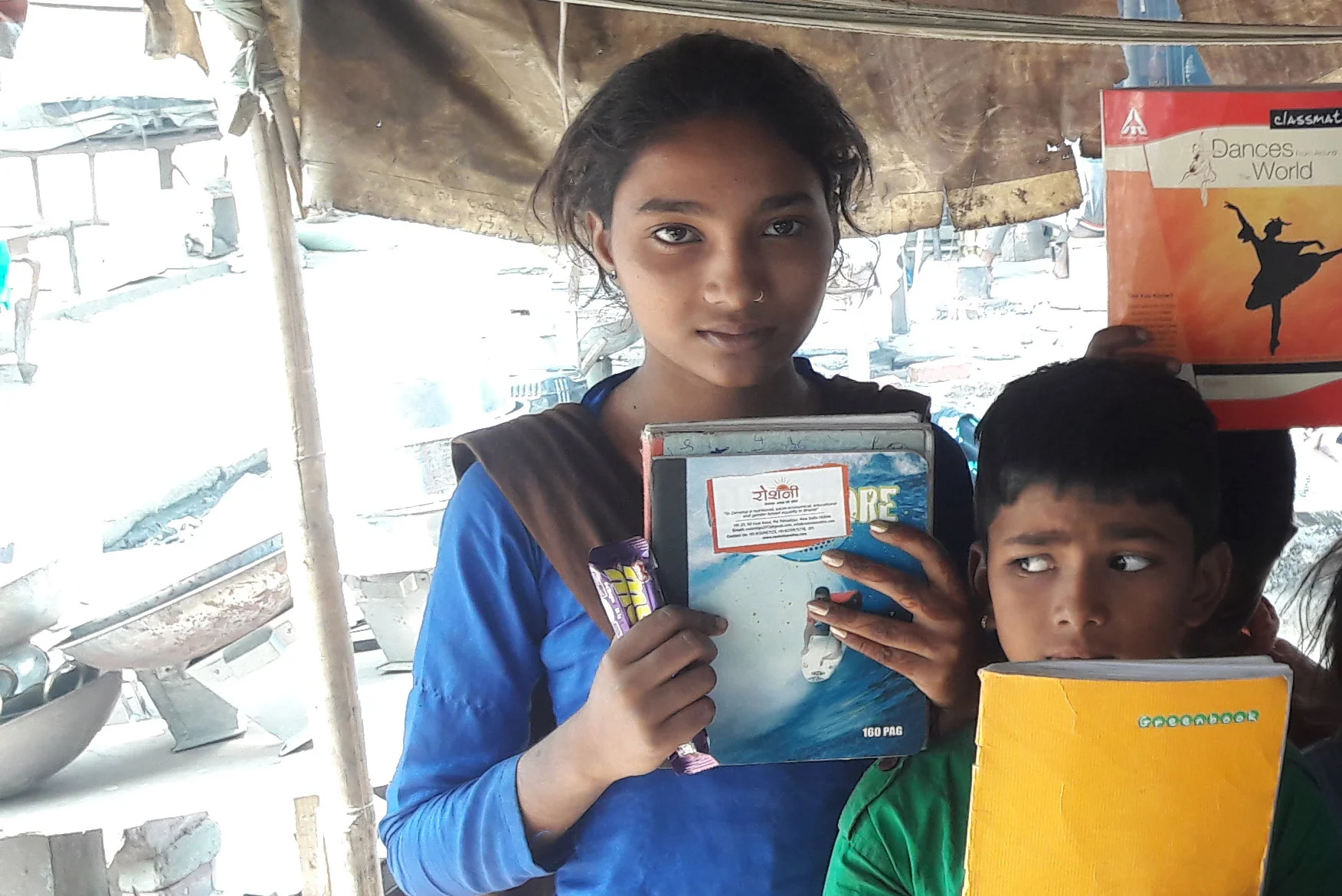

Eligibility of ROSHNI NGO: Donations to ROSHNI NGO, an organization focused on child and women empowerment in Delhi NCR, are eligible for tax exemptions. This means donors not only support a cause that brings real change but also enjoy tax savings on their contributions.

Types of Tax Deductible Donations

The Indian tax system distinguishes between different types of donations, setting varied deduction rates based on the nature of the organization. Broadly, there are two main categories:

- 50% Deduction Category: Donations to general-purpose NGOs fall into this category, allowing donors to deduct half the donated amount from their taxable income.

- 100% Deduction Category: NGOs and funds recognized for specific causes (such as disaster relief, education for the underprivileged, or empowerment programs) may be eligible for 100% deductions. Donations to ROSHNI NGO, which works to empower children and women, may qualify under this higher deduction bracket, making it a financially efficient choice for donors.

Simple Documentation and Transparent Receipts

Registered NGOs issue donation receipts that serve as proof for tax claims. These receipts typically include:

- Details of the donation (amount and purpose).

- The NGO’s registration number and tax-exempt status.

- The donor’s details, which helps in straightforward tax filing.

Since ROSHNI NGO is a registered organization, donors receive all necessary documentation, ensuring transparency and easy compliance. This system not only instills confidence in donors but also guarantees a smooth tax exemption process.

“Help uplift underprivileged children and empower women while saving on taxes! Consider a donation to ROSHNI NGO today and be a part of positive change.”

Comments